Supreme Court Rules in Favor of Marriage Equality

June 26, 2015 By Leave a Comment

The Supreme Court, in a landmark 5-4 decision, has ruled that same-sex marriage is a right guaranteed by the 14th Amendment and that a States are thus required to both license a marriage between two people of the same sex and recognize a lawful same-sex marriage performed out-of-State. (Obergefell v. Hodges)

The majority opinion, written by Justice Kennedy and joined by Justices Ginsburg, Breyer, Sotomayor, and Kagan, described the history of marriage as “one of both continuity and change,” and described the Court’s jurisprudence on marriage as guaranteeing a fundamental right that carries with it a host of social, economic, and legal consequences.

Four separate dissents were filed by Chief Justice Roberts and Justices Scalia, Thomas, and Alito.

Although Obergefell is not a tax case, it will certainly impact the taxes of same-sex married couples. Many same-sex couples have been subject to conflicting treatment of their marital status by the State and Federal government because, although the Supreme Court’s Windsor decision in 2013 mandated Federal recognition of same-sex marriage, it did not compel that States do the same.

Form 1040: An Unappreciated Work Of Art

March 4, 2015 By Leave a Comment

ou might think I’m crazy, but every tax season reminds me that I think Form 1040 is a thing of beauty. It is a work of art and a brilliant one at that.

Think about it: the entire individual income tax, comprising hundreds of sections, thousands of words, and almost countless regulations, explanations, and instructions, all broken down into a single two-sided sheet of paper. What do accountants mean when they talk about “above the line”? Just look at Form 1040. Wonder what the difference is between gross income and adjusted gross income and why it’s important? Form 1040 will tell you.

What is a deduction? Is it different from a credit? Is one better than the other? Form 1040 doesn’t only tell you, it shows you. It’s all there, from exemptions to itemized deductions. Business expenses, farm income, moving expenses, alimony payments, the treatment of IRAs, energy credits — even the dreaded alternative minimum tax. It’s all there

Granted, information is funneled into the form from a veritable gaggle of schedules, worksheets, and other places. But how all of it is channeled and ends up on a single page is part of the brilliance. It’s a magnificent design that was first introduced in 1913. (You can see the form’s evolution at our own Tax History Project.)

Form 1040 contains about 80 lines. But in the end, it all comes down to two numbers: what you owe the government, or what the government owes you. Everything that is entered on this form must be correct, because you are responsible for the information you’ve provided and must attest to that.

Law schools, take note: If you really want to teach tax, start with Form 1040. To take a simple example, a few weeks ago The New York Times (“To Win at the Game, First Know the Rules,” Feb. 14, 2015, at BU12) used an annotated Form 1040 to help its readers better understand how the tax system can work for them. Which precisely illustrates my point — to learn the rules, start with the 1040.

Some may call me a certifiable tax nerd for getting such pleasure out of a simple form, but I consider that a compliment. Because I find Form 1040 more beautiful, alluring, and mysterious than the Mona Lisa herself. Now there’s something you don’t read every day.

http://www.forbes.com/sites/taxanalysts/2015/03/03/form-1040-an-unappreciated-work-of-art/?ss=taxes

.

Tax Deadlines coming up

January 6, 2015 By Leave a Comment

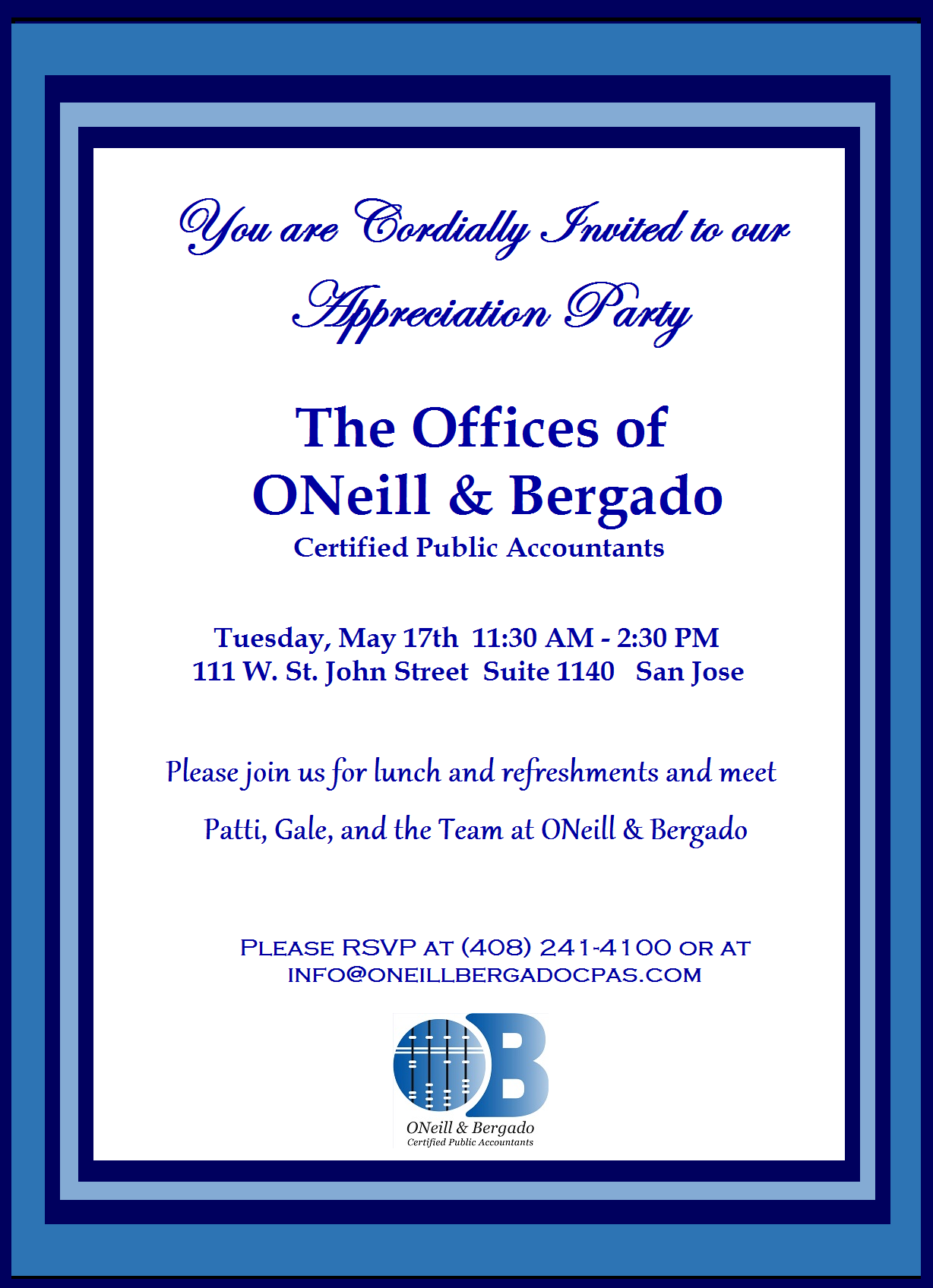

To all friends and clients of ONeill & Bergado, Inc., Certified Public Accountants

Individual, trust and partnership tax returns are due Wednesday, April 15. Any additional tax due on those 2014 tax returns is due at that time. Corporate returns are due on Monday, March 16.

There are also additional filing requirements that must be met this time of year for businesses and individuals, which you may not be aware of. The following is a brief description of a few “other” tax-filing requirements that may be important to know:

Forms 1099-MISC must be filed for all payments of $600 or more to non-corporate entities for services provided. These forms are due to the recipients by January 31, 2015. Most importantly, they also must be filed with the Internal Revenue Service no later than February 28, 2015. There may be extended deadlines for electronically filing these forms.

Fourth quarter and year-end payroll tax returns, including Form 941, Form DE 6, Form 940, Form DE 7, as well as Form W-2 and related Form W-3, are all due by January 31, 2015. Many payroll service companies will prepare these forms for you. In addition, if you employed any household help during the year, you are required to report all wages paid to them – the “nanny tax” filing requirement.

San Francisco Payroll Tax Statements must be filed by February 28, 2015. This filing requirement only applies to those businesses that operate in San Francisco. The penalty for not filing a return by the February 28 deadline is severe, especially for those businesses that normally qualify for the Small Business Exemption and have no tax due. If a business does not file on time, the $2,500 Small Business Exemption will NOT apply and the entire computed tax PLUS a $500 penalty becomes due.

Forms 571-L (Property Tax Statements) are due by April 1, 2015. The county in which you do business will mail Form 571-L to you. You are required to report certain property used in your business so that the county assessor’s office can determine how much property tax you owe (usually billed to you in July or August). There may be extended deadlines for electronically filling these forms.

We know the next few months can be hectic and hope this information will help you plan ahead with filing deadlines to come. If you would like to get an early start on preparation on any of these forms, please be sure to send your information to us at least two weeks prior to the filing deadline to ensure timely filing. We are available to help you with your needs with the preparation of any and all of these “other” tax filing requirements.

If you have any questions on the information or specific filing requirements, feel free to contact us.

IRS Warns of Tax Scams

January 23, 2014 By Leave a Comment

It’s true: tax scams proliferate during the income tax filing season. This year’s season opens on Jan. 31. The IRS provides the following scam warnings so you can protect yourself and avoid becoming a victim of these crimes:

- Be vigilant of any unexpected communication purportedly from the IRS at the start of tax season.

- Don’t fall for phone and phishing email scams that use the IRS as a lure. Thieves often pose as the IRS using a bogus refund scheme or warnings to pay past-due taxes.

- The IRS doesn’t initiate contact with taxpayers by email to request personal or financial information. This includes any type of e-communication, such as text messages and social media channels.

- The IRS doesn’t ask for PINs, passwords or similar confidential information for credit card, bank or other accounts.

- If you get an unexpected email, don’t open any attachments or click on any links contained in the message. Instead, forward the email to phishing@irs.gov. For more about how to report phishing scams involving the IRS visit the genuine IRS website, IRS.gov.

Don’t get caught by any of the scams. If you have any questions, give us a call and we can tell you whether it is valid or not.

Here are several steps you can take to help protect yourself against scams and identity theft:

- Don’t carry your Social Security card or any documents that include your Social Security number or Individual Taxpayer Identification Number.

- Don’t give a business your SSN or ITIN just because they ask. Give it only when required.

- Protect your financial information.

- Check your credit report every 12 months.

- Secure personal information in your home.

- Protect your personal computers by using firewalls and anti-spam/virus software, updating security patches and changing passwords for Internet accounts.

- Don’t give personal information over the phone, through the mail or on the Internet unless you have initiated the contact and are sure of the recipient.

- Be careful when you choose a tax preparer. Most preparers provide excellent service, but there are a few who are unscrupulous. Refer to Tips to Help you Choose a Tax Preparer for more details.

ONeill & Bergado has moved

January 23, 2014 By Leave a Comment

Hello everyone. We are finally in our new space at 111 W. St. John Street, Suite 1140, San Jose. We will be having an open house on Thursday, February 13 from 5:30 – 8:30 pm. Come by and see our new place. Hannah Tanner has joined our team as a full time receptionist administrative team member… you will meet her when you visit. She is a great addition to our team.

IRS to Employers: Hire Veterans by Dec. 31 and Save on Taxes

December 20, 2013 By Leave a Comment

If you plan to hire soon, consider hiring veterans. If you do, you may be able to claim the federal Work Opportunity Tax Credit worth thousands of dollars.

You must act soon. The WOTC is available to employers that hire qualified veterans before the new year.

Here are six key facts about the WOTC:

1. Hiring Deadline. Employers hiring qualified veterans before Jan. 1, 2014, may be able to claim the WOTC. The credit was set to expire at the end of 2012. The American Taxpayer Relief Act of 2012 extended it for one year.

2. Maximum Credit. The tax credit limit is $9,600 per worker for employers that operate a taxable business. The limit for tax-exempt employers is $6,240 per worker.

3. Credit Factors. The credit amount depends on a number of factors. They include the length of time a veteran was unemployed, the number of hours worked and the amount of the wages paid during the first year of employment.

4. Disabled Veterans. Employers hiring veterans with service-related disabilities may be eligible for the maximum tax credit.

5. State Certification. Employers must file Form 8850, Pre-Screening Notice and Certification Request for the Work Opportunity Credit, with their state workforce agency. They must file the form within 28 days after the qualified veteran starts work. For more information, visit the U.S. Department of Labor’s WOTC website.

6. E-file. Some states accept Form 8850 electronically.

IRS Warns of Phone Scam

November 11, 2013 By Leave a Comment

The IRS is warning the public about a phone scam that targets people across the nation, including recent immigrants. Callers claiming to be from the IRS tell intended victims they owe taxes and must pay using a pre-paid debit card or wire transfer. The scammers threaten those who refuse to pay with arrest, deportation or loss of a business or driver’s license.

The callers who commit this fraud often:

- Use common names and fake IRS badge numbers.

- Know the last four digits of the victim’s Social Security number.

- Make caller ID appear as if the IRS is calling.

- Send bogus IRS emails to support their scam.

- Call a second time claiming to be the police or DMV, and caller ID again supports their claim.

The truth is the IRS usually first contacts people by mail – not by phone – about unpaid taxes. And the IRS won’t ask for payment using a pre-paid debit card or wire transfer. The agency also won’t ask for a credit card number over the phone.

If you get a call from someone claiming to be with the IRS asking for a payment, here’s what to do:

- If you owe federal taxes, or think you might owe taxes, hang up and call the IRS at 800-829-1040. IRS workers can help you with your payment questions.

- If you don’t owe taxes, call and report the incident to the Treasury Inspector General for Tax Administration at 800-366-4484.

- You can also file a complaint with the Federal Trade Commission at FTC.gov. Add “IRS Telephone Scam” to the comments in your complaint.

Be alert for phone and email scams that use the IRS name. The IRS will never request personal or financial information by email, texting or any social media. You should forward scam emails to phishing@irs.gov. Don’t open any attachments or click on any links in those emails.

Renting Your Vacation Home

July 30, 2013 By Leave a Comment

A vacation home can be a house, apartment, condominium, mobile home or boat. If you own a vacation home that you rent to others, you generally must report the rental income on your federal income tax return. But you may not have to report that income if the rental period is short.

In most cases, you can deduct expenses of renting your property. Your deduction may be limited if you also use the home as a residence.

Here are some tips from the IRS about this type of rental property.

• You usually report rental income and deductible rental expenses on Schedule E, Supplemental Income and Loss.

You may also be subject to paying Net Investment Income Tax on your rental income.

• If you personally use your property and sometimes rent it to others, special rules apply. You must divide your expenses between the rental use and the personal use. The number of days used for each purpose determines how to divide your costs.

Report deductible expenses for personal use on Schedule A, Itemized Deductions. These may include costs such as mortgage interest, property taxes and casualty losses.

• If the property is “used as a home,” your rental expense deduction is limited. This means your deduction for rental expenses can’t be more than the rent you received. For more about this rule, see Publication 527, Residential Rental Property (Including Rental of Vacation Homes).

• If the property is “used as a home” and you rent it out fewer than 15 days per year, you do not have to report the rental income.

Tips for Taxpayers Who Travel for Charity Work

July 12, 2013 By Leave a Comment

Do you plan to travel while doing charity work this summer? Some travel expenses may help lower your taxes if you itemize deductions when you file next year. Here are five tax tips the IRS wants you to know about travel while serving a charity.

1. You must volunteer to work for a qualified organization. Ask the charity about its tax-exempt status. You can also visit IRS.gov and use the Select Check tool to see if the group is qualified.

2. You may be able to deduct unreimbursed travel expenses you pay while serving as a volunteer. You can’t deduct the value of your time or services.

3. The deduction qualifies only if there is no significant element of personal pleasure, recreation or vacation in the travel. However, the deduction will qualify even if you enjoy the trip.

4. You can deduct your travel expenses if your work is real and substantial throughout the trip. You can’t deduct expenses if you only have nominal duties or do not have any duties for significant parts of the trip.

5. Deductible travel expenses may include:

- Air, rail and bus transportation

- Car expenses

- Lodging costs

- The cost of meals

- Taxi fares or other transportation costs between the airport or station and your hotel